Real Estate in Turkey in 2026: Current Situation, Sales Statistics, Price Dynamics, and Market Forecasts

The Turkish real estate market in 2026 remains one of the most discussed and sought-after destinations among buyers and investors. Over the past few years, the Turkish housing market has undergone a period of rapid growth, correction, and stabilization, making it more mature and predictable.

Real estate price dynamics for 2024–2025 showed that housing prices in Turkey continue to rise in nominal terms, while the market adapts to new economic conditions. Experts agree that Turkish real estate will retain its investment appeal in 2026, particularly in major cities and popular resort areas.

In this analytical article, we will examine the current situation on the Turkish real estate market, official sales statistics, price dynamics, regional indicators, and market development forecasts for 2026.

The current real estate situation in Turkey

As of late 2025 and early 2026, the Turkish real estate market is characterized by relative stability after a period of sharp price increases. Despite the high inflation of previous years and changes in financial policy, the real estate sector remains a key means of preserving capital for both Turkish citizens and foreign buyers.

Economic processes in recent years have led to real estate beginning to perform several functions at once:

a hedge against inflation;

long-term investment instrument;

source of passive income;

a way to legalize residence in Turkey.

Turkey continues to attract buyers with its mild climate, developed tourist infrastructure, high-quality construction, and strategic geographic location between Europe and Asia. Properties in major cities and coastal regions are particularly sought after, driven not only by buyers but also by the rental market.

The shrinking supply of land in the central areas of major cities and resorts is having a significant impact on the market. This limits supply and supports prices even during periods of reduced buyer activity.

Statistics and analysis of real estate sales in Turkey

According to the latest data published by TÜİK , 1,688,910 residential properties will be sold in Turkey in 2025, representing an increase of 14.3% compared to 2024. These figures confirm the market's recovery after the decline in activity in previous periods.

Sales structure:

primary market (new buildings): about 540,786 properties;

secondary market: about 1,148,124 objects;

Mortgage transactions: approximately 236,668 sales.

Leading cities in terms of total transaction volume:

Istanbul - 280,262 transactions;

Ankara - 152,534 transactions;

Izmir - 96,998 transactions.

Sales to foreign citizens

In 2025, foreigners purchased 21,534 properties, accounting for approximately 1.3% of total transactions. Despite the decline in the share of foreign buyers, the market remains resilient due to strong domestic demand.

The most popular regions among foreigners:

Istanbul - 7,989 objects;

Antalya - 7,118 objects;

Mersin - about 1,800 objects.

The most active nationalities of buyers:

citizens of Russia;

buyers from Iran;

citizens of Ukraine.

The small share of foreign transactions in the overall sales structure is considered a positive factor, as it reduces the market's dependence on foreign policy and geo-economic fluctuations.

3. Statistics and dynamics of real estate prices in Turkey

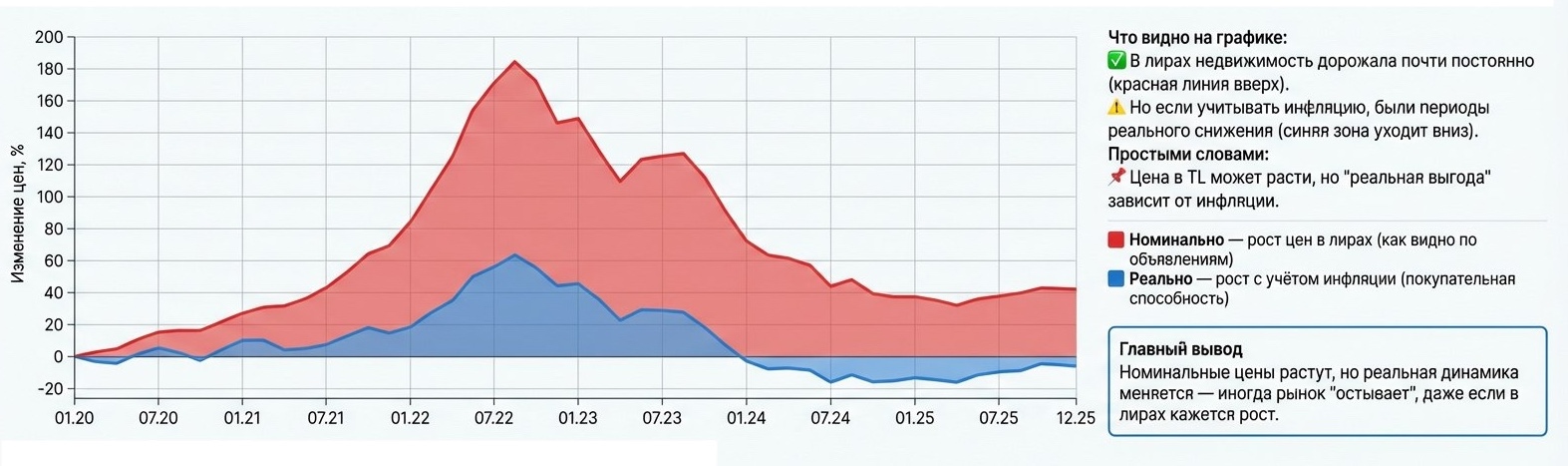

Expectations of a sharp decline in Turkish real estate prices have not materialized. By the end of 2025, the market showed nominal growth, but more subdued real growth.

According to the Endeksa analytics platform for December 2025:

the average nominal growth in housing prices was about 27% year-on-year;

taking inflation into account, real price dynamics were close to zero;

the average price per square meter in the country is about 37,800 TL/m²;

the average price of a residential property is approximately 4.7 million TL;

The average payback period for investments is about 14 years.

Data from the Central Bank of Turkey confirms the general trend: the house price index continues to grow nominally, but the rate of growth is gradually slowing, indicating market stabilization.

It is important to note that in tourist regions and large cities (Istanbul, Antalya, Alanya), price growth traditionally outpaces the national average, especially in the liquid real estate segment.

Statistics by city

The highest concentration of real estate transactions in Turkey traditionally occurs in a few key cities and regions. These include Istanbul, Antalya, Alanya, Ankara, and Mersin . These locations are characterized by high liquidity, developed infrastructure, and consistent demand from both local residents and foreign buyers.

Below we will consider the price dynamics and market characteristics in each of these cities.

Istanbul

Istanbul remains Turkey's largest financial, business, cultural, and tourist center. The city attracts buyers thanks to its robust economy, vibrant labor market, developed transportation infrastructure, and stable rental demand.

As of the end of 2025, approximately 30% of real estate transactions still occurred in the Asian part of the city, while the European part remains more popular among foreign buyers. A significant share of transactions are concluded on the secondary market, indicating high liquidity and active resale of properties.

Market experts note a reduction in exposure periods: the average time for a property to be listed on the Istanbul market is approximately 1–1.5 months, indicating a high level of demand.

In recent years, real estate price growth in Istanbul has remained among the most stable in the country. The most significant price increases have been recorded in the districts of Beykoz, Sarıyer, Beşiktaş, Cataltepe, and Zeytinburnu , while more moderate growth has been observed in Çatalca, Beylikdüzü, Ümraniye, Kadıköy, and Bağcılar .

Average prices for Istanbul:

average price per square meter: ≈ $1,200/m²

average area of the object: ≈ 115 m²

Average apartment price: ≈ $138,000

average payback period: ≈ 17 years

Antalya

Antalya Province remains one of Turkey's most popular resort regions and a key magnet for investors. High tourist traffic, developed infrastructure, and active construction support stable demand for real estate.

In recent years, Antalya has demonstrated active development: a large number of construction permits have been issued, modernization of transport and social infrastructure continues, and the tourism sector has fully recovered.

The main buyers of real estate in Antalya remain citizens of Russia, Iran, Iraq, and Germany. The region has seen steady price growth, particularly in the modern residential complexes segment.

In recent years, property prices in Antalya have increased by more than 140%, confirming its investment appeal.

Average prices for Antalya:

average price per square meter: ≈ $1,050/m²

average area of the object: ≈ 115 m²

Average apartment price: ≈ $121,000

average payback period: ≈ 18 years

Alania

Alanya is one of the most sought-after resort towns in the Mediterranean and a leader in foreign real estate sales. The city combines a favorable climate, developed infrastructure, high-quality service, and stable rental demand.

In recent years, buyers from Russia, Ukraine, Iraq, Iran, and Germany have been the most active in the market. However, demand is gradually shifting toward higher-quality and more liquid properties.

Real estate price growth in Alanya has exceeded 130% in recent years, with the most moderate growth observed in the districts of Mahmutlar, Cikcilli, Tosmur and Demirtas.

Average indicators for Alanya:

average price per square meter: ≈ $1,470/m²

average apartment area: ≈ 110 m²

Average home price: ≈ $162,000

average payback period: ≈ 23 years

Ankara

Ankara, as Turkey's capital and major administrative center, has demonstrated one of the highest housing price growth rates in recent years. The market here is largely driven by domestic demand and is relatively stable.

The highest growth in real estate prices was recorded in the districts of Beypazarı, Polatlı, and Çubuk, while more moderate dynamics were observed in Balat, Sincan, Ayaş, and Yenimahalle.

Average indicators for Ankara:

average price per square meter: ≈ $650–700/m²

average area of the object: ≈ 130 m²

Average property price: ≈ $85,000

average payback period: ≈ 14 years

Mersin

Mersin is a business and industrial city on the Mediterranean Sea that has been rapidly developing as a tourism and investment destination in recent years. The region attracts buyers with more affordable prices while maintaining growth potential.

The highest price increases were recorded in the districts of Gulnar, Bozyazi, Tarsus, Mut and Yenişehir , while more moderate dynamics were noted in Akdeniz, Anamur and Erdemli .

Average figures for Mersin:

average price per square meter: ≈ $710/m²

average area of the object: ≈ 145 m²

Average property price: ≈ $103,000

average payback period: ≈ 17 years

Turkey's Real Estate Market Forecasts for 2026

Market experts agree that real estate in Turkey will continue to grow moderately in 2026. The reasons for this forecast are as follows:

Key factors:

High construction costs. Rising prices for building materials and labor continue to put pressure on the cost of new buildings.

Limited land supply. In the central areas of major cities and resorts, available land is virtually exhausted.

The rate of new project completion is declining. The number of construction permits remains below peak levels.

Stable domestic demand. Turkish citizens play a dominant role in the market, making it less vulnerable to external factors.

The country's migration and investment policies deserve special attention. Purchasing real estate remains one of the most popular ways to obtain residency, as well as participate in the citizenship by investment program.

5. Interactive chart of predicted prices

For a visual analysis of the dynamics and forecasts of real estate prices in Turkey, it is recommended to use interactive charts based on:

Central Bank of Turkey's house price index;

Endeksa regional data;

comparison of nominal and real price growth.

These tools allow you to assess regional trends, identify the most promising areas, and choose the optimal purchasing strategy.

Is it worth buying property in Turkey in 2026?

Buying property in Turkey in 2026 remains a popular choice for both personal residence and investment. Despite rising prices, the market offers a wide selection of properties in various price segments—from affordable apartments to premium residences.

Key benefits:

protection of capital from inflation;

potential for long-term value growth;

stable rental demand;

the possibility of obtaining a residence permit or citizenship;

Comparatively low taxes and costs of owning real estate.

Result

The Turkish real estate market in 2026 is balanced, stable, and mature, with clear rules of the game. Price growth has slowed but not stopped, and liquid properties in major cities and resort areas remain in high demand.

Real estate in Turkey remains a reliable asset, combining comfortable living, investment potential, and ample opportunities for foreigners.

See also